Venture capital can be defined as the investment made available in a budding company that shows potential for growth and generating profits. However, the new company being funded also has a possibility of incurring a loss. Venture capital is normally in form of people buying shares in a company and hence becoming shareholders. It was initially defined as risk capital because investors did not know in what direction the business would head. However, this term has since been discontinued. Venture capitalists are the people offering investments or investing in the new business hoping that it will expand and eventually give them back their contributions and dividends every so often. They believe that the company will grow after getting past all the risk factors involved in a new company. Venture capitalists believe that their business sense and know how will enable them steer the business in the direction they want it to take.

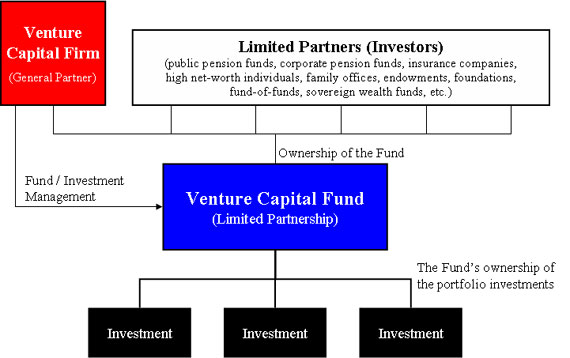

Normally, a business will have venture capitalists from different genres and will therefore each bring something different to the table. Investors expect an annual return of between 20 and 50% of their investment in form of dividends. Unlike in private equity, investors have not tested the ground of the new business and have not seen the company actually generating income. This poses a great risk because investors are likely to either make high returns or lose all their investment when the business does not pick up as expected. To ensure that the risk is spread widely, venture capitalists usually come together and invest in a pool of funds that is used to facilitate many start-ups and therefore increase the chances of a successful business among the many.

Firms that deal in venture capital comprise of people who are considered experts in their different fields or have extensive training in a particular industry. It is these people who bring high net worth individuals together and float the ideas of investing in different genres. A required skill in venture capital is the ability to look at different technology and identify those that are able to bring back profits in the early stages of the business. Venture capital also involves management skills to ensure that the intended achievements are met. This comes in form of expertise that the capitalists have from their different backgrounds.

Venture capital normally involves industries that are not very commonly traded and have potential of growing and making investors money. One of the most attractive industries for venture capital is the internet. Many investors believe that the internet as an industry has not been tapped into entirely and still has potential to make many people rich. When the internet had just been discovered, there was a very high venture capital rate recorded due to the potential the internet bore and the chance of doing business in the territory where not many had ventured. However, after several years, investors now realize that online business have just as many chances of failing and succeeding as other ordinary businesses. Therefore, before investing in any industry, venture capitalists turn to experts for advice and opinions on what to invest their resources in.